Welcome to A New England Nanny

The Capital Region’s Premier Household Employment Agency

Child Care ♦ Senior Care ♦ Housekeeping

Corporate Backup Care ♦ Hotel & Event Care

Expert Care and Services by Skilled Professionals

We’ve been providing peace of mind to Capital Region families since 1991. Our range of services include:

Child Care

Full-time or part-time live-out nanny care, nanny shares, babysitting, after-school tutoring and more.

Senior Care

We offer non-medical services for seniors, such as companionship and running errands.

Corporate Backup Care

Your employees can go to work while we send a professional caregiver to their home.

Housekeeping & Other Services

Home cleaning, meal preparation, transportation, and other help around the house.

Hiring Nannies in New York's Capital Region

We always have open positions. Work with New England Nanny and:

- You will be treated as a professional by our staff who respects your career needs.

- We qualify the families and match them to your unique needs and skills.

- You will avoid safety concerns by knowing that we have reputable families who we have screened beforehand.

- We provide you with guidelines on how to get the best compensation package.

Hiring Nannies in New York's Capital Area

We always have open positions. Work with New England Nanny and:

- You will be treated as a professional by our staff who respects your career needs.

- We qualify the families and match them to your unique needs and skills.

- You will avoid safety concerns by knowing that we have reputable families who we have screened beforehand.

- We provide you with guidelines on how to get the best compensation package.

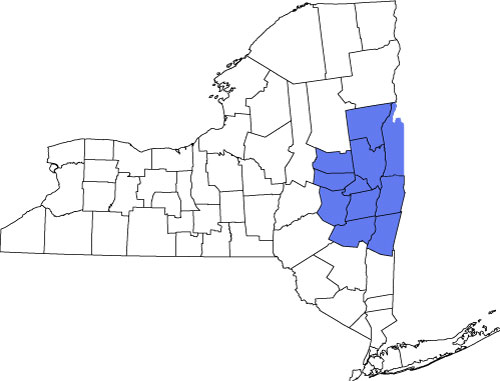

Extensive Capital Region Coverage

A New England Nanny agency provides nannies and household employees who have undergone thorough background checks. Give us a call and let us do the work of finding the perfect fit for your needs.

- Albany

- Columbia

- Fulton

- Greene

- Montgomery

- Rensselaer

- Saratoga

- Schenectady

- Schoharie

- Warren

- Washington

Why Use an Agency?

Using an agency gives you many advantages, including:

- Better qualified candidates that match your needs

- Security knowing that candidates have undergone thorough background checks

- Save time and avoid the hassle of doing it alone

- Retention – your nanny will stay with you for longer

Why Use an Agency?

Using an agency gives you many advantages, including:

- Better qualified candidates that match your needs

- Security knowing that candidates have undergone thorough background checks

- Save time and avoid the hassle of doing it alone

- Retention – your nanny will stay with you for longer